🔑 This $44 billion deal failed in just a few years

|

Welcome to The Business Buying Academy with Sieva Kozinsky. Here's what we have in store for you today:

🔑 When leverage fails What happens when a massive bet goes horribly wrong? Today we're going to walk through a disaster of a deal - one that still haunts private equity. In 2007, a group of investors executed the largest LBO in history (at the time), acquiring TXU Energy. KKR, TPG Capital, and Goldman Sachs bought TXU, a utility provider, for $44.3 billion The deal, heavily debt-financed like most LBOs, was a big bet on rising energy prices and deregulation in Texas’ electricity market. Rising energy prices = Higher profits for utilities. But that plan didn't work out. This deal is a cautionary tale of over-leverage and misjudged market dynamics, ending in bankruptcy. Summary of the deal:

Outcome:

The TXU LBO is a textbook case of private equity hubris and the dangers of leverage. I've talked many times about the importance of margin of safety when buying a business. Many investors only focus on the growth case when buying a business. But what happens when you have a bad first year and revenue drops 20%? Ask yourself: Will you have enough margin for error to weather the storm and figure out how to get the company back on track? Or will everything come crashing down thanks to massive debt payments? 🔑 Off-Market Childcare & Early Learning Center Not every deal makes it to the open market. This childcare and early learning center has been part of the Phoenix community since 2002, serving families for over two decades. With ~$2.5M+ in revenue and ~$1.5M+ in earnings, it’s a steady cash-flow business in a sector where demand doesn’t go away. The center’s reputation is long-established, and for the right buyer, there’s upside in modernizing operations, refreshing marketing, and expanding enrollment. Why this stood out:

If you want more details about this deal, set up your buyer profile on Mainshares and get matched with off-market deals that fit your search. This message is not investment advice. Do your own research before allocating capital. Thanks to our sponsor, Mainshares, for supporting thoughtful small business investing. 🔑 Here's how you can buy a business I chatted with Brian Wolfe, an expert on M&A from all levels - he worked as a partner at a big law firm for 17 years, helping to close huge deals. Now he's in the world of ETA (entrepreneurship through acquisition). He helps searchers get started, and he's bought some businesses himself - including a rollup of marketing SaaS businesses. Brian gave me a masterclass on buying businesses. Have a great day, Sieva P.S. - Are you hiring? Get started with top global talent from Somewhere (I'm a customer and investor) What did you think of today's newsletter? Rate this newsletter using the poll below: Disclaimer: nothing here is investment advice. Please do your own research. The information above is just for information and learning. |

Sieva Kozinsky

Learn how to buy businesses in 5-minutes or less, once a week. Lessons & specific tactics on how invest your money and generate cash flow for your life.

Welcome to The Business Buying Academy with Sieva Kozinsky. Here's what we have in store for you today: This blockbuster acquisition flopped in just 3 years He bought a small business - and sold it for a 24x return 🔑 This blockbuster acquisition flopped in just 4 years Name a better business to get into during the 1980s than movie theaters. It's tough to do. Think of all the blockbuster hits of the 90s: Jurassic Park. Titanic. Forrest Gump. Star Wars Episode 1. The Lion King. Friday night in...

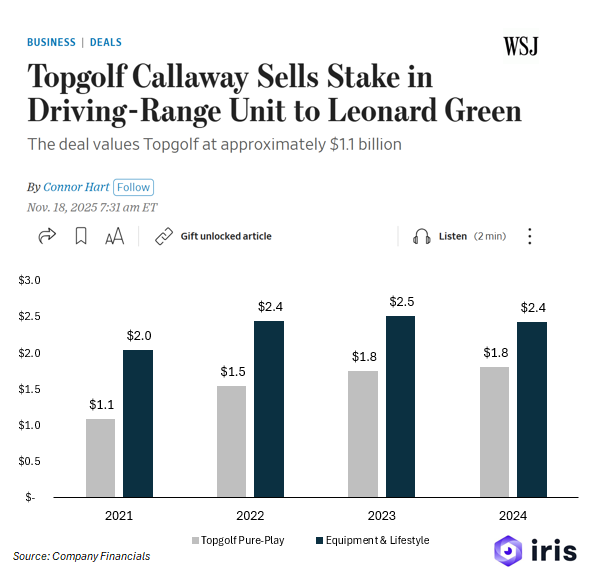

Welcome to The Business Buying Academy with Sieva Kozinsky. Here's what we have in store for you today: "Discount Jewelry" vs. "Affordable Luxury" - this simple rebrand made $182 million $1.1 billion PE acquisition I talked with 20+ business buyers - here's what they told me 🔑 This LBO netted $182 million in just 26 months When people talk about the golden age of private equity, the conversation usually jumps straight to KKR’s acquisition of RJR Nabisco. It's the most famous LBO ever. But...

Welcome to The Business Buying Academy with Sieva Kozinsky. Here's what we have in store for you today: How to rollup a boring industry Avoid this business buying mistake Buying $5 billion in real estate (here's how he did it) 🔑 Textbook M&A deal in a boring industry I usually write about historical M&A deals from decades past. This week, let's switch it up and talk about a recent deal in a boring industry: Industrial reliability services. You probably haven't heard of this business, so let's...