🔑 Discount jewelry vs. Affordable Luxury - this simple rebrand made $182 million

|

Welcome to The Business Buying Academy with Sieva Kozinsky. Here's what we have in store for you today:

🔑 This LBO netted $182 million in just 26 months When people talk about the golden age of private equity, the conversation usually jumps straight to KKR’s acquisition of RJR Nabisco. It's the most famous LBO ever. But ultimately, it wasn't the most profitable. There are hundreds of other deals that happened right around the same time - including some that quietly made investors a fortune. In 1988, KKR won the largest and most ferocious LBO battle in history by acquiring RJR Nabisco for $25 billion ($31 billion including assumed debt) in a dramatic auction immortalized in the book Barbarians at the Gate. The deal became the high-water mark of the 1980s leveraged buyout boom, loaded the company with crushing debt, and ultimately delivered only modest returns to KKR after a painful decade-long restructuring and piecemeal asset sales. Today I want to cover a much smaller deal with a large return. I think it's a more realistic learning experience for those of you looking to buy your own SMB. While the RJR Nabisco deal made headlines, this one quietly returned a much higher multiple to its investors. The Deal Let's talk about the $28 million leveraged buyout of Sterling Jewelers, a regional chain of 102 jewelry stores headquartered in Akron, Ohio. About Sterling Jewelers:

The Buyer Thomas H. Lee, who I've written about before, acquired Sterling Jewelers. This was before he started his firm (Thomas H. Lee Company), which ended up becoming one of the most famous names in PE. In 1985, Thomas was 41 years old and had left Lehman Brothers a decade earlier to strike out on his own. His tiny firm had done a handful of mid-market deals, but nothing that moved the needle nationally. He was hungry for a breakout. He and his partner spotted Sterling while screening for public companies in fragmented retail niches. Jewelry retailing in the U.S. was (and still is) extremely fragmented; there are thousands of mom-and-pops stores and a bunch of regional players. Sterling was valuable to Lee because it had some scale and a clean balance sheet. Deal Structure

In just 26 months, Lee earned a 7.5x return on his invested capital. Let's take a look at how they did it: The Playbook

The Exit In July 1987, less than 26 months after closing, THL sold Sterling to Signet Group for $210 million in cash. That's a clean 7.5× return on the original $28 million equity check, and an IRR north of 140%. Signet kept the Sterling name for years in the U.S. before eventually folding the stores into the Kay and Jared banners. Today, most of those original Sterling locations live on under the Signet umbrella (market cap ≈ $4 billion as of 2025). Why This Deal Still Matters in 2025

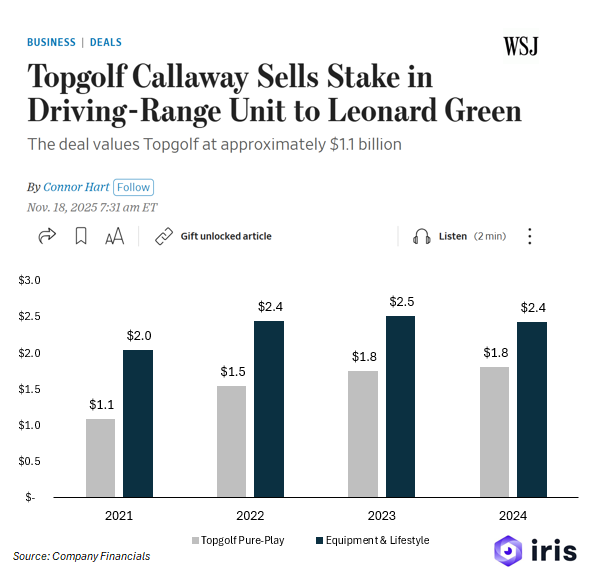

🔑 Topgolf sells to PE Big news in the golf/entertainment world this morning: Topgolf is officially getting a new majority owner PE firm Leonard Green & Partners just struck a deal to buy 60% of the Topgolf business for a total enterprise value of about $1.1 billion. Callaway, which merged with Topgolf in 2021, keeps 40% and walks away with roughly $770 million in cash after everything shakes out. Callaway’s been doing a full strategic review for the past 14 months (originally they were talking spin-off), but ultimately decided to sell off a majority stake instead.

🔑 Want to buy a business? Start here If you've read this newsletter for any amount of time, you know I'm obsessed with buying businesses. And I love talking to others who have bought companies. I've recorded dozens of conversations with some of the best business buyers I know - and I've put them all online for you to listen to. There are hundreds of years of lessons on business buying for you to absorb. Ranging from a $1 million accounting firm to $100 million hotels, we've got a bit of everything. We've got self-funded searchers, private equity partners with billions under management, and horizontal holding company owners who buy a new business every month. My goal: Assemble the greatest collection of business buying lessons from people who have really done it. No matter what type of business you're looking to buy, I probably have a story for you. Check out the interviews below. Have a great day, Sieva P.S. - Are you hiring? Get started with top global talent from Somewhere (I'm a customer and investor) What did you think of today's newsletter? Rate this newsletter using the poll below: Disclaimer: nothing here is investment advice. Please do your own research. The information above is just for information and learning. |

Sieva Kozinsky

Learn how to buy businesses in 5-minutes or less, once a week. Lessons & specific tactics on how invest your money and generate cash flow for your life.

Welcome to The Business Buying Academy with Sieva Kozinsky. Here's what we have in store for you today: Ford's Deal to Buy Ferrari - What Went Wrong He Bought a Pallet of Watches and Turned it into $2.4 Million 🔑 Their deal fell apart - so they decided to build instead In 1963, Ford Motor Company attempted to acquire the iconic Italian car maker Ferrari. But the deal eventually fell apart. The story sparked one of racing's greatest rivalries, and a 2019 blockbuster movie, Ford v. Ferrari. For...

Welcome to The Business Buying Academy with Sieva Kozinsky. Here's what we have in store for you today: They bought a business in 2008 just before the crash, but still made ~$1 billion How to buy an accounting business (without being an accountant) 🔑 Making ~$1 billion buying a business in 2008 Imagine buying a business in February 2008, just months before the global economy melted down. Anyone who did that must have lost a fortune, right? Not in this case. Today we are looking at the deal...

Welcome to The Business Buying Academy with Sieva Kozinsky. Here's what we have in store for you today: A $71 million buyout with culture fit issues Learn to buy any type of business 🔑 An LBO with culture fit issues Over the last few months, I've written about deals that either failed spectacularly or were massive homeruns. Today, I'm writing about one that's somewhere in between. It was a good deal with a pretty good result, but it was hampered by a culture fit issue. Let's dive in. The Deal...