🔑 A 60x return in just a few years

|

Welcome to The Business Buying Academy with Sieva Kozinsky. Here's what we have in store for you today:

🔑 A $1.5 billion profit & and a $1.4 billion loss I love reading about old private equity deals. The other day, I happened to stumble upon this gem of a deal: The 1992 leveraged buyout of beloved, quirky drink brand Snapple. With a relatively small investment, the buyer made a massive return. I'll unpack the deal's details, its dramatic aftermath, and a couple actionable lessons for aspiring business buyers. Let's dive in. Founded in 1972 by Leonard Marsh, Hyman Golden, and Arnold Greenberg as Unadulterated Food Products, Snapple started as a small operation selling health juices to stores in New York. The name "Snapple" came from a carbonated apple juice that "snapped" when opened. The brand truly exploded in the late 1980s with its all-natural iced teas and fruit drinks, marketed as "Made from the Best Stuff on Earth." Revenue surged from $13.3 million in 1988 to around $231 million in 1992. You might remember their unconventional advertising. The company's quirky image, complete with fun facts on bottle caps and a down-to-earth vibe, resonated in the emerging "New Age" beverage category, setting it apart from soda giants like Coke and Pepsi. The 1992 Buyout Thomas H. Lee Partners (THL), a Boston-based private equity firm acquired Snapple for approximately $135 million in a classic LBO, putting down just $28 million in equity and financing the rest with debt. The founders retained about a third of the company and stayed on in management roles. This deal was a bet on Snapple's untapped potential: A cult-favorite brand with strong cash flows from its network of over 30 independent bottlers and distributors...but no owned manufacturing facilities (opportunity to vertically integrate). THL didn't overhaul operations dramatically. Instead, they amplified what worked. Just eight months post-acquisition, THL took Snapple public in a December 1992 IPO that many were skeptical of... but the stock quickly climbed. The 1994 Buyout The real payday came in 1994 when Quaker Oats acquired Snapple for a staggering $1.7 billion. THL achieved a 12x return on total investment and an estimated 60x on their equity stake in just two years. Sales grew to $774 million by then. and the business was looking great.

They were unlikely candidates for multimillionaire status. Hyman Golden and Leonard Marsh were window washers. And Arnold Greenberg ran a food store on New York's Lower East Side. But last week the trio that founded Snapple Beverage Corp. walked away with at least $130 million each from the sale of Snapple to the Quaker Oats Co. Quaker offered $1.7 billion for the trendy iced-tea and juice maker, creating the third largest nonalcoholic-beverage marketer in North America. - Newsweek, November 1994 But Quaker's ownership of the brand turned disastrous. Eager to integrate Snapple with its Gatorade success, Quaker shifted distribution from Snapple's small, dedicated network to large supermarket chains - alienating the brand's grassroots appeal. They toned down the quirky marketing, leading to stagnating sales and a loss of cultural fit. By 1997, Quaker sold Snapple for a mere $300 million, swallowing a $1.4 billion loss - one of the biggest corporate flops in history. In a span of just 5 years, one investor made over $1.5 billion, and another lost nearly the same amount - from owning the exact same company. Lessons:

🔑 Don't make this mistake when buying a business Buying a business without getting a quality of earnings report is like buying a house without a home inspection. You’re taking a big bet without knowing what you’re buying, and it could be a disaster. Even if the seller gives you all their financial statements, they often have very bad bookkeeping. So, what should be in your QOE and financial due diligence package? Here's what today's sponsor Appletree says about their QOE reports: ✅ Proof of Cash Are revenues real? We rebuild the last 1-2 years using bank statements to verify that reported earnings arrived in the bank account. ✅ Addbacks That Actually Make Sense We normalize SDE or EBITDA with logic, not wishful thinking. The hand-waving. No “adjusting away” real costs just to make numbers look better. ✅ Working Capital Analysis Avoid the “Post-Close Surprise” where you’re suddenly short $150k in working capital. We calculate what the business needs to operate smoothly. ✅ Forward Looking Projections We model post close cash flow and debt service coverage under flat, growth, and decline scenarios – so you know how risky the deal really is. If you’re sending out LOI’s or nearing a deal, don’t go in blind. Talk to Appletree for a pragmatic, thorough Quality of Earnings report – built by people who’ve bought businesses themselves. 🔑 Want to buy a business? Pay attention I've been interviewing dozens of people over the last year. My goal: Assembling the greatest collection of business buying lessons from people who have done it. Their businesses range from $1 million accounting firm to $100 million manufacturing businesses, and everything in between. We've got self-funded searchers, private equity partners with billions under management, and horizontal holding company owners looking to add the next great business to their portfolio. No matter what type of business you're looking to buy, I probably have a story for you. Check out the interview below. Have a great day, Sieva P.S. - Are you hiring? Get started with top global talent from Somewhere (I'm a customer and investor) What did you think of today's newsletter? Rate this newsletter using the poll below: Disclaimer: nothing here is investment advice. Please do your own research. The information above is just for information and learning. |

Sieva Kozinsky

Learn how to buy businesses in 5-minutes or less, once a week. Lessons & specific tactics on how invest your money and generate cash flow for your life.

Welcome to The Business Buying Academy with Sieva Kozinsky. Here's what we have in store for you today: This blockbuster acquisition flopped in just 3 years He bought a small business - and sold it for a 24x return 🔑 This blockbuster acquisition flopped in just 4 years Name a better business to get into during the 1980s than movie theaters. It's tough to do. Think of all the blockbuster hits of the 90s: Jurassic Park. Titanic. Forrest Gump. Star Wars Episode 1. The Lion King. Friday night in...

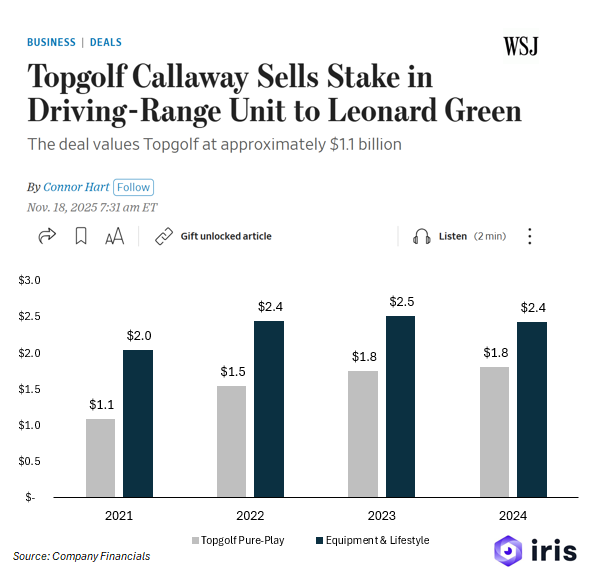

Welcome to The Business Buying Academy with Sieva Kozinsky. Here's what we have in store for you today: "Discount Jewelry" vs. "Affordable Luxury" - this simple rebrand made $182 million $1.1 billion PE acquisition I talked with 20+ business buyers - here's what they told me 🔑 This LBO netted $182 million in just 26 months When people talk about the golden age of private equity, the conversation usually jumps straight to KKR’s acquisition of RJR Nabisco. It's the most famous LBO ever. But...

Welcome to The Business Buying Academy with Sieva Kozinsky. Here's what we have in store for you today: How to rollup a boring industry Avoid this business buying mistake Buying $5 billion in real estate (here's how he did it) 🔑 Textbook M&A deal in a boring industry I usually write about historical M&A deals from decades past. This week, let's switch it up and talk about a recent deal in a boring industry: Industrial reliability services. You probably haven't heard of this business, so let's...